It is the trading entity's obligation to understand and comply with the legal requirements and the digital record keeping rules for business. However, it does not guarantee or enforce compliance because requirements vary based on business scenarios. The Peppol eInvoicing standard can be used to issue an invoice that meets legal requirements. The record transmitted to the customer needs to contain all information required for a tax invoice.

#Consultation invoice template portable

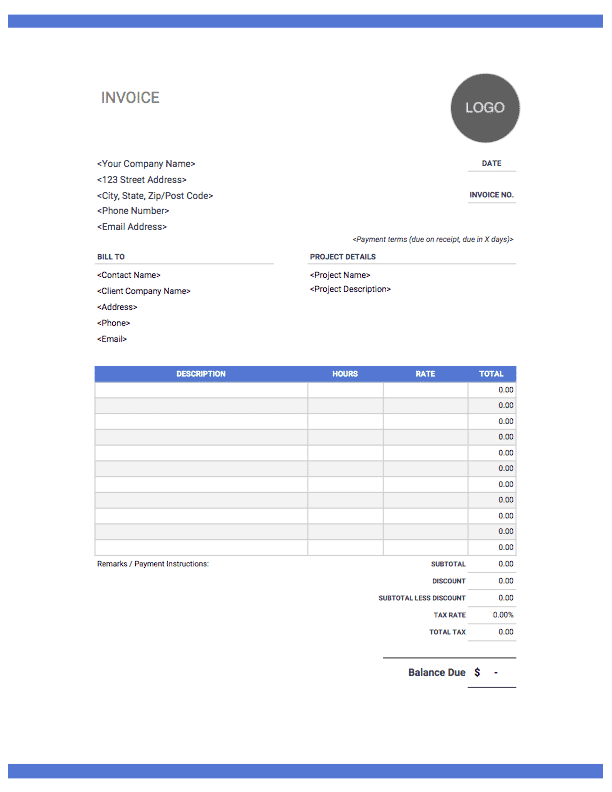

emailing an invoice in portable document format (PDF).

#Consultation invoice template software

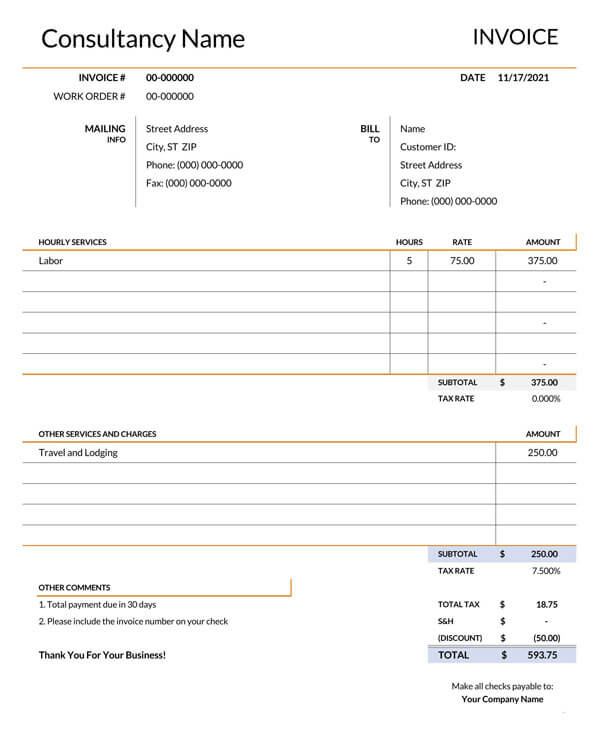

using eInvoicing (Peppol eInvoice), an automated direct exchange of invoices between a supplier's and buyer's software.eInvoicing and digital invoicesĪ tax invoice doesn't need to be issued in paper form.įor example, you can issue a tax invoice to a customer by: GST 2001/8 Goods and services tax: Apportioning the consideration for a supply that includes taxable and non-taxable parts provides more detail about apportioning. Use ASIC's MoneySmart GST calculator External Link to calculate the amount of GST you will pay or should charge customers. Items are non-taxable if they are GST-free or input-taxed. Taxable and non-taxable salesĪ tax invoice that includes taxable and non-taxable items, must clearly show which items are taxable.

GSTR 2013/1 Goods and services tax: tax invoices sets out the information requirements for a tax invoice in more detail. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax (WEG) label, you need further information to claim GST credits and for it to be considered a valid tax invoice.

If a customer asks for a tax invoice, you must provide one within 28 days, unless it is for a sale of $82.50 (including GST) or less. Explains when to provide a tax invoice, what it must include and dealing with non-taxable sales and rounding.

0 kommentar(er)

0 kommentar(er)